PowerIn’s mission is to eliminate losses in power supply from hazards that routinely impact the local power grid, by efficiently converting abundant supplies of low cost natural gas into primary electric power and high quality heat instead of wastefully flaring this God given natural resource.

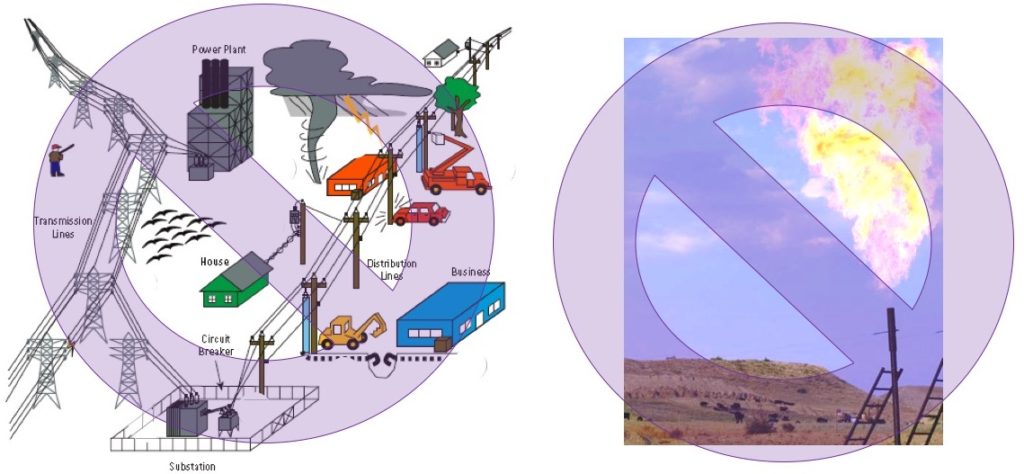

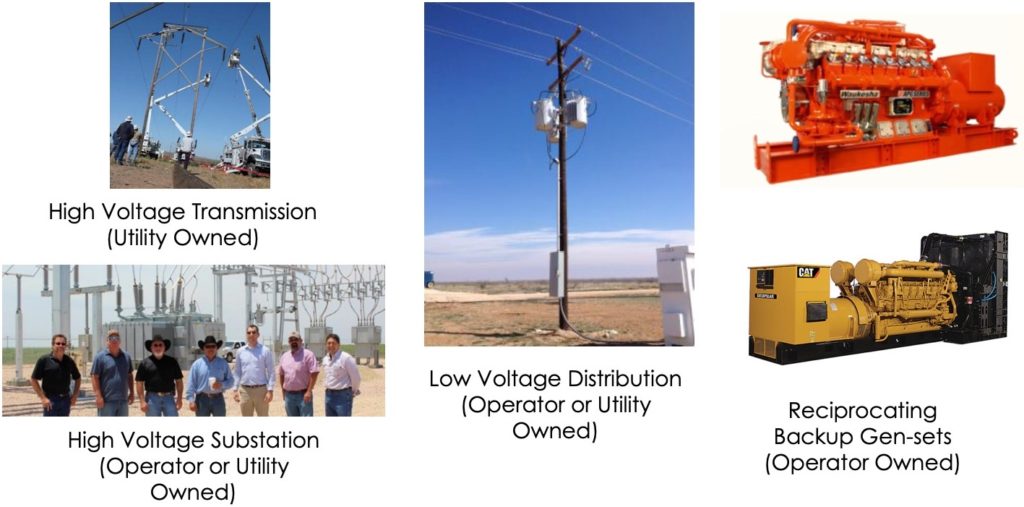

Traditional approaches for the supply of electric power to upstream and midstream oil and gas operations includes a combination of high voltage transmission power lines, low to medium voltage distribution power lines and substations, as well as natural gas and diesel backup generators.

High voltage transmission lines are commonly owned by utility companies regulated by their respective states. Medium to low voltage power lines and substations are either owned by the regulated utility or by local oil and gas operators.

When adequate grid supply is not available, onsite diesel and natural gas fueled generators are rented to temporarily electrify substations and power lines, as well as upstream and midstream field operations.

Midstream operators at times choose high emitting gas driven facilities rather than more efficient and environmentally friendly electric driven designs due to insufficient local availability of electric power.

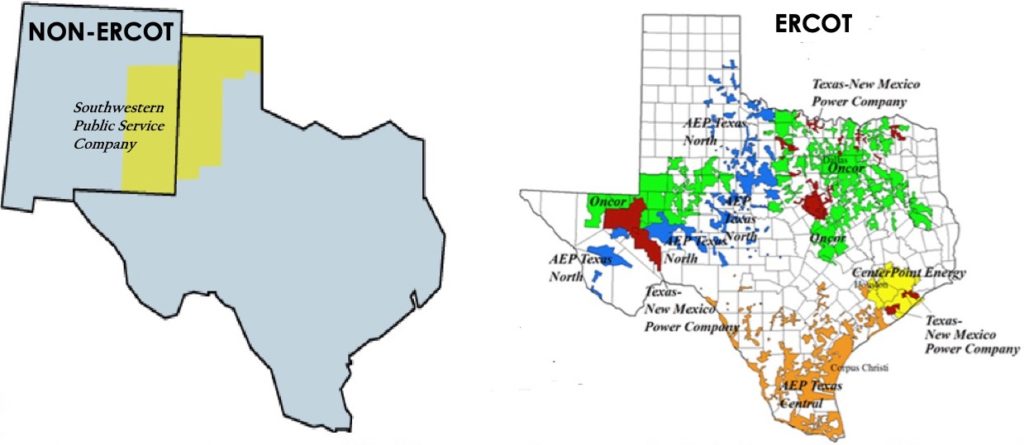

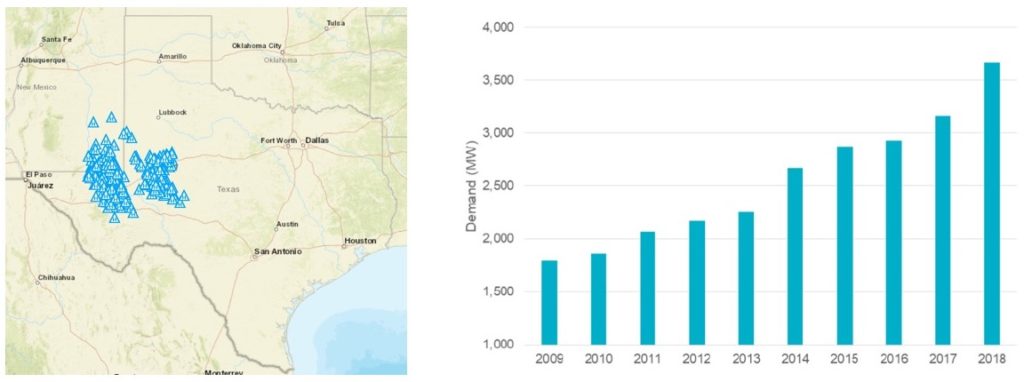

Source: Xcel Energy – SPS Retail Service Territory

Multiple utility companies provide transmission and distribution voltage power to the Permian region. Within the Texas portion of the Permian, the State’s regulated independent system operator, ERCOT primarily manages grid switching operations and the wholesale power market with the exception of where Southern Public Service Company (XCEL Energy) operates.

In general, utility companies associated with ERCOT are attempting to expand capacity for both transmission and distribution power lines in response to projected growth within the Permian.

However, to date utilities have not kept up in a timely fashion with rapidly changing demand for electric power, particularly within the Delaware basin.

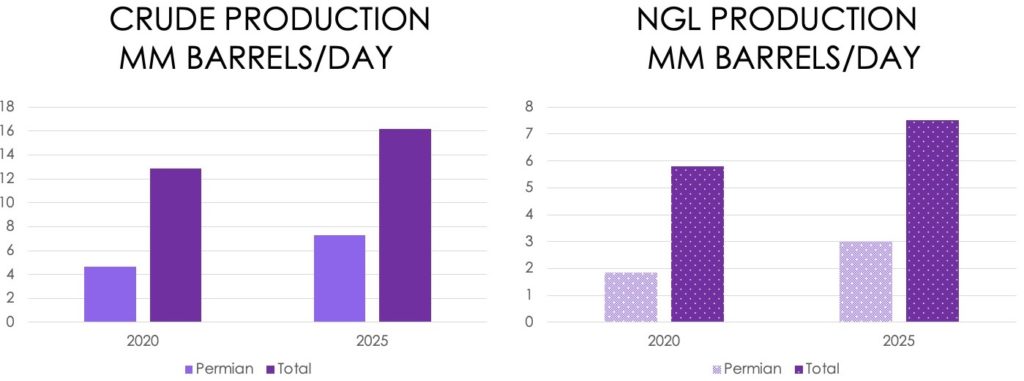

Global crude oil supply and demand were in relative balance throughout 2017 and 2018, at around 100 million barrels per day. In June of 2018 the United States produced over 10% of global crude supply, and began producing more oil than any other country in the world, a title it has not held since 1973.

This achievement is attributed to the United States’ leadership position in the recent development and commercialization of horizontal drilling, coupled with horizontal fracturing that has created the ability to “unconventionally” produce oil and gas from geological formations previously thought to be void of producible petroleum resources. Over 50% of US crude oil production during 2018 occurred at regions located within the Eagle Ford (central and southwest Texas) and the Permian (west Texas and south New Mexico).

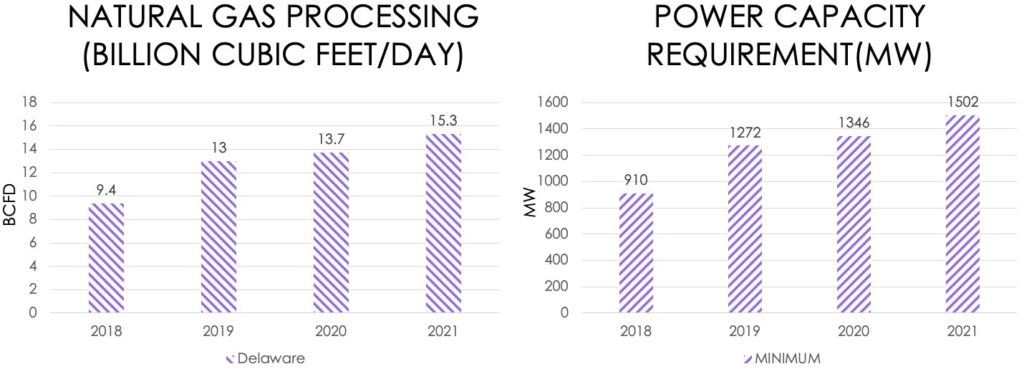

Both regions have been experiencing rapid growth in production due to low exploration, development and production costs. Thick multi-stacked geological formations, especially within the Permian, coupled with a shift to horizontal drilling and fracturing has created record high growth in the production of oil and “rich” natural gas. Gas produced alongside oil within the Delaware basin is particularly rich in ethane, propane, butane and pentane, all of which must be first processed out prior to shipping natural gas to market.

Fortunately for the Permian region producers, these longer chain elements are in heavy demand as low cost feedstocks for the Gulf Coast petrochemical complex, when compared to naphtha which historically served as the primary feedstocks to produce ethylene and propylene as a precursor to the production of plastic.

By 2025, industry forecasts project a growth in U.S. exports of oil rising to 8 million barrels, with associated increases in exports of ethane, liquid petroleum gas, liquefied natural gas, and plastics such as polyethylene and polypropylene, all of which are significantly driving increases in production of oil, natural gas and natural gas liquids within the Permian.

Source: Report on Existing and Potential Electric System Constraints and Needs, December 2018

PowerIn is initially focused on the Permian region because demand for resilient, reliable, high quality power currently exceeds the local utility company’s ability to supply.

In addition, natural gas driven processing plants struggle to stay below federally mandated Title V air emission limits when they attempt to expand operations to support the growing demand for upstream and midstream oil and gas operations.

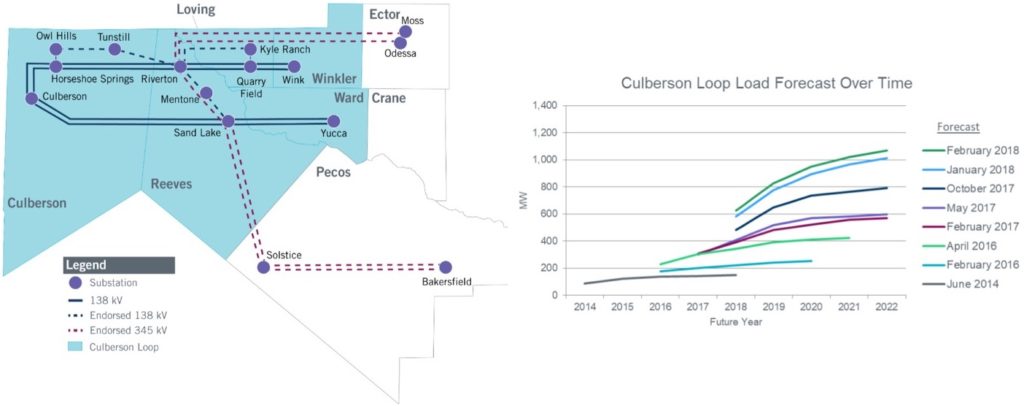

During 2011, demand for electricity within the Culberson Loop of the Delaware basin was 22MW. In 2018, demand had reportedly grown to 400MW, and by 2020 was forecasted to exceed 1000MW.

To satisfy this demand, the Electric Reliability Council of Texas (ERCOT) has endorsed installation of additional power transmission that account for most of the 966 million dollars of improvements underway within ERCOT’s Far West weather region.

While there is an expectation that these projects will bring relief to the current shortage of power, transmission improvements can take two to six years to complete planning studies, routing analyses, regulatory approvals, route acquisitions, design, construction and commission.

As an example, the transmission system of 2018 was largely planned between 2012 and 2015, but ERCOT’s forecast for 2018 within the Delaware increased substantially in 2016 and 2017.

Projected demand for the Culberson Loop, located within the Delaware basin, continued to increase monthly, further adding strain to the local utility companies’ ability to meet exponential growth in demand.

Actually, current projected annual increases in natural gas processing capacity alone of 1.5 billion cubic feet/day is creating an increase in power demand of 500MW more than what had previously been authorized by ERCOT for transmission build-out within the Delaware basin (Culberson Loop).